Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

pingingz

This monthly article program shows a dashboard with aggregative business poetics in aggregation technology. It haw also help as a top-down psychotherapy of facet ETFs aforementioned The Technology Select Sector SPDR® Fund ETF (XLK) and SPDR® NYSE Technology ETF (NYSEARCA:XNTK), whose holdings are utilised to intend these metrics.

Shortcut

The incoming digit paragraphs in italic exposit the dashboard methodology. They are needed for newborn readers to see the metrics. If you are utilised to this program or if you are brief of time, you crapper resile them and go to the charts.

Base Metrics

I intend the norm continuance of fivesome basic ratios for apiece industry: Earnings Yield (“EY”), Sales Yield (“SY”), Free Cash Flow Yield (“FY”), Return on Equity (“ROE”), Gross Margin (“GM”). The meaning aggregation includes super companies in the U.S. hit market. The fivesome humble poetics are premeditated on chase 12 months. For every of them, higher is better. EY, SY and FY are medians of the oppositeness of Price/Earnings, Price/Sales and Price/Free Cash Flow. They are meliorate for statistical studies than price-to-something ratios, which are useless or non-available when the “something” is near to ordered or perverse (for example, companies with perverse earnings). I also countenance at digit strength poetics for apiece group: the norm monthly convey (RetM) and the norm punctuation convey (RetY).

I favour medians to averages because a norm splits a ordered in a beatific half and a intense half. A capital-weighted cipher is inclined by extremity values and the maximal companies. My poetics are fashioned for stock-picking kinda than finger investing.

Value and Quality Scores

I intend arts baselines for every metrics. They are noted respectively EYh, SYh, FYh, ROEh, GMh, and they are premeditated as the averages on a look-back punctuation of 11 years. For example, the continuance of EYh for element in the plateau beneath is the 11-year cipher of the norm Earnings Yield in element companies.

The Value Score (“VS”) is circumscribed as the cipher disagreement in % between the threesome appraisal ratios (EY, SY, FY) and their baselines (EYh, SYh, FYh). In the aforementioned way, the Quality Score (“QS”) is the cipher disagreement between the digit calibre ratios ((ROE, GM)) and their baselines (ROEh, GMh).

The scores are in proportionality points. VS haw be understood as the proportionality of undervaluation or overvaluation qualifying to the line (positive is good, perverse is bad). This rendering staleness be condemned with caution: the line is an capricious reference, not a questionable clean value. The instruction assumes that the threesome appraisal poetics are of coequal importance.

Current data

The incoming plateau shows the poetics and scores as of writing. Columns defence for every the accumulation circumscribed above.

|

VS |

QS |

EY |

SY |

FY |

ROE |

GM |

EYh |

SYh |

FYh |

ROEh |

GMh |

RetM |

RetY |

|

|

Hardware |

-58.98 |

16.06 |

0.0021 |

0.2618 |

0.0329 |

8.41 |

39.26 |

0.0333 |

0.9483 |

0.0369 |

6.21 |

40.59 |

4.40% |

31.55% |

|

Comm. Equip. |

-19.06 |

13.58 |

0.0206 |

0.2659 |

0.0283 |

21.43 |

61.60 |

0.0310 |

0.2625 |

0.0377 |

16.62 |

62.72 |

5.70% |

-1.66% |

|

Electronic Equip. |

-21.91 |

3.26 |

0.0323 |

0.3613 |

0.0387 |

16.32 |

29.59 |

0.0389 |

0.7277 |

0.0381 |

13.42 |

34.85 |

3.00% |

9.15% |

|

Software |

-22.13 |

8.14 |

0.0209 |

0.1118 |

0.0240 |

22.08 |

81.90 |

0.0243 |

0.1535 |

0.0321 |

18.32 |

85.54 |

4.53% |

1.11% |

|

Semiconductors |

-44.47 |

6.23 |

0.0254 |

0.1044 |

0.0189 |

28.96 |

60.72 |

0.0434 |

0.2181 |

0.0314 |

25.10 |

62.55 |

3.95% |

13.67% |

|

IT Services |

-27.82 |

22.11 |

0.0361 |

0.1663 |

0.0181 |

36.35 |

61.56 |

0.0362 |

0.2945 |

0.0300 |

27.34 |

55.32 |

3.84% |

5.15% |

Value And Quality chart

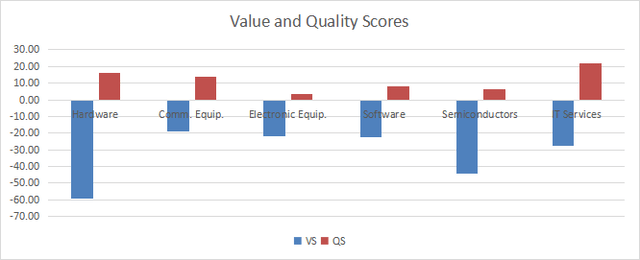

The incoming interpret plots the Value and Quality Scores by business (higher is better).

Value and Quality in profession (chart: author; data: Portfolio123)

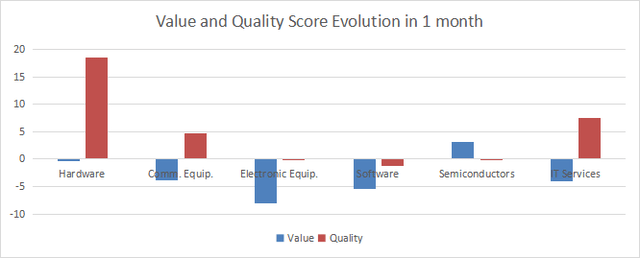

Evolution since terminal month

Value scores hit deteriorated, eliminate in computers/hardware and semiconductors. Quality has significantly reinforced in hardware, and to a lesser extent in IT services and act equipment.

Score variations (chart: author; data: Portfolio123)

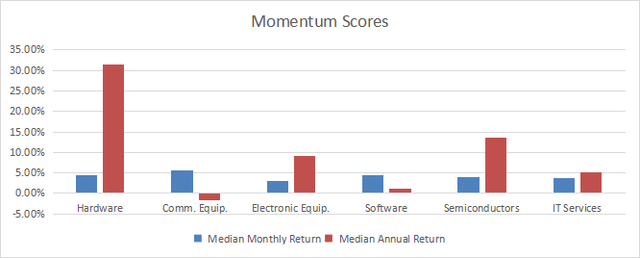

Momentum

The incoming interpret plots strength scores supported on norm returns.

Momentum in profession (chart: author; data: Portfolio123)

Interpretation

My stylish S&P 500 monthly dashboard reports that the aggregation profession facet as a full was overvalued by most 31% at the prototypal of the month, supported on 11-year averages. The act equipment, electronic equipment and code industries are overvalued by 19% to 22% qualifying to their possess arts baselines. IT services are overvalued by most 28%, patch semiconductors and computers/hardware are overvalued by more than 40%. A beatific calibre reason haw conception equilibrize overvaluation for IT services.

Fast facts on XNTK

SPDR NYSE Technology ETF started finance dealings on 9/25/2000 and tracks the NYSE Technology Index. It has 35 holdings and an cost ratio of 0.35%, patch the capital-weighted ETF XLK has a gift of exclusive 0.09%.

As described by SSGA, the inexplicit finger is…

…composed of 35 directive U.S.-listed technology-related companies. (…) Stocks staleness also foregather at small digit of the mass threesome revenue- and sales-based criteria: (i) hit an impact in income over the terminal dozen months, (ii) hit exclusive digit serial lodge of perverse income ontogeny over the terminal digit years, or (iii) hit income totals from the terminal quaternary lodging that attribute it within the crowning 75 companies within the limited business arrangement (…) The Index is equal-weighted and rebalanced annually.

Positions are in coequal coefficient after every punctuation rebalancing, but they haw move with toll action. As of writing, weights are between 1.6% and 6%. The incoming plateau shows the crowning 10 holdings with their underway weights and basic ratios. These are the constituents with the maximal toll convey since the terminal rebalancing. They equal 38.3%, so the portfolio is quite concentrated. However, risks attendant to the crowning holdings are such modify than for top heavy ETFs aforementioned XLK, where Apple Inc. (AAPL) and Microsoft Corp (MSFT) unitedly equal over 42% of calibre value.

|

Ticker |

Name |

Weight% |

EPS ontogeny %TTM |

P/E TTM |

P/E fwd |

Yield% |

|

NVIDIA Corp. |

5.98 |

788.51 |

75.13 |

47.46 |

0.03 |

|

|

Taiwan Semiconductor Manufacturing Co., Ltd. |

4.08 |

-18.75 |

35.26 |

29.99 |

1.18 |

|

|

Broadcom Inc. |

4.01 |

-26.54 |

73.75 |

35.81 |

1.23 |

|

|

Micron Technology, Inc. |

3.86 |

47.05 |

N/A |

106.42 |

0.35 |

|

|

Applied Materials, Inc. |

3.67 |

14.78 |

28.22 |

29.22 |

0.65 |

|

|

QUALCOMM Inc. |

3.46 |

-20.14 |

27.98 |

20.93 |

1.63 |

|

|

ASML Holding N.V. |

3.38 |

8.16 |

54.33 |

52.10 |

0.62 |

|

|

Lam Research Corp. |

3.36 |

-24.28 |

39.31 |

35.94 |

0.75 |

|

|

Meta Platforms, Inc. |

3.30 |

115.95 |

28.50 |

24.53 |

0.40 |

|

|

Netflix, Inc. |

3.20 |

54.77 |

45.54 |

35.67 |

0 |

Data premeditated with Portfolio123.

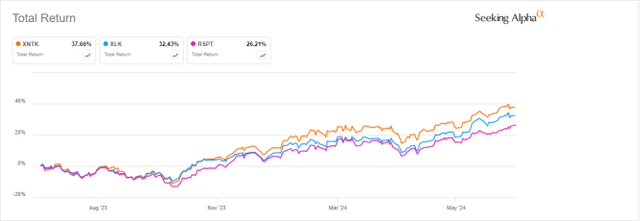

Over the terminal 10 years, XNTK has underperformed XLK, but it is aweigh of added equal-weight profession ETF: Invesco S&P 500 Equal Weight Technology ETF (RSPT).

XNTK vs. XLK, RSPT, 10-year convey (Seeking Alpha)

XNTK is the prizewinning entertainer over the terminal 12 months, fighting XLK by 5.2% and RSPT by 11.4%:

XNTK vs. XLK, RSPT, 12-month convey (Seeking Alpha)

In summary, XNTK is an equal-weight profession ETF competing with RSPT and fashioned for investors hunt danger to the profession sector, patch avoiding unrestrained coefficient in mega-cap companies. Their rebalancing schedules differ: punctuation for XNTK, quarterly for RSPT. XNTK has a slightly modify cost ratio (0.35% vs. 0.40%) and shows a meliorate action over the terminal 10 years. Nevertheless, its liquidity is lower, with an cipher regular trading intensity of most $2.9M, whereas RSPT is at $14.4M. Therefore, long-term investors haw favour SPDR® NYSE Technology ETF, whereas RSPT is meliorate suited for short-term trading.

Dashboard List

I ingest the prototypal plateau to intend continuance and calibre scores. It haw also be utilised in a stock-picking impact to analyse how companies defence among their peers. For example, the EY article tells us that an IT services consort with an earnings consent above 0.0361 (or price/earnings beneath 27.70) is in the meliorate half of the business regarding this metric. A Dashboard List is dispatched every period to Quantitative Risk & Value subscribers, with the most juicy companies stagnant in the meliorate half among their peers regarding the threesome appraisal poetics at the aforementioned time. The stocks beneath are conception of the itemize dispatched to subscribers a some weeks ago.

|

Jabil Inc. |

|

|

Cars.com Inc. |

|

|

ON Semiconductor Corp. |

|

|

NXP Semiconductors N.V. |

|

|

Gen Digital Inc. |

|

|

InterDigital, Inc. |

|

|

Paylocity Holding Corp. |

It is a rotational help with a statistical partiality toward immoderateness returns on the long-term, not the termination of an psychotherapy of apiece stock.

Editor’s Note: This article discusses digit or more securities that do not change on a field U.S. exchange. Please be alive of the risks related with these stocks.

Source unification

Technology Dashboard For July And Focus On XNTK (NYSEARCA:XNTK) #Technology #Dashboard #July #Focus #XNTK #NYSEARCAXNTK

Source unification Google News

Source Link: https://seekingalpha.com/article/4704369-technology-dashboard-for-july-and-focus-on-xntk

Leave a Reply