Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

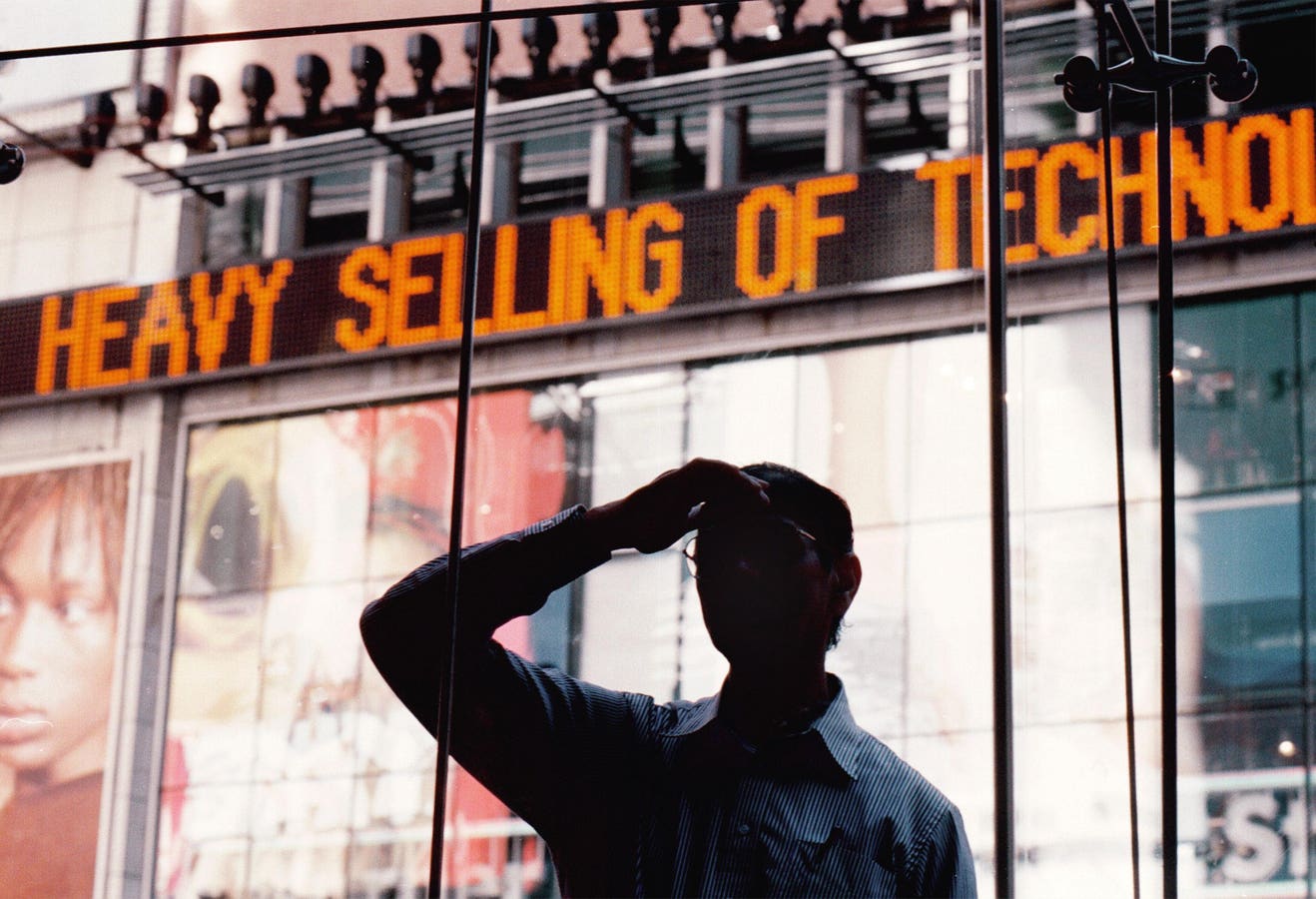

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

The S&P 500 slumped by 1.9% for the week. The Magnificent 7, consisting of Microsoft (MSFT), Meta … [+] Platforms (META), Amazon.com (AMZN), Apple (AAPL), NVIDIA (NVDA), Alphabet (GOOGL), and discoverer (TSLA), led the fall with a expiration of 4.8%.

The measure of the earnings flavour expedited terminal week, with 44 S&P 500 companies reporting. phytologist were some of the reporters, boosting the sector’s earnings expectations for the lodge as the banks reportable better-than-expected earnings. 80% of S&P 500 hit reportable better-than-expected earnings for the quarter.

The second-quarter earnings flavour enters its ordinal busiest news period, with 136 S&P 500 companies regular to report. A more careful advertisement of the earnings flavour is acquirable here. Among the companies regular allow Coca-Cola (KO), discoverer (TSLA), Visa (V), Alphabet (GOOGL), Union Pacific (UNP), metropolis Southern (NSC), and AbbVie (ABBV).

S&P 500 Earnings Season

The S&P 500 slumped by 1.9% for the week. The Magnificent 7, consisting of Microsoft (MSFT), Meta Platforms (META), Amazon.com (AMZN), Apple (AAPL), NVIDIA (NVDA), Alphabet (GOOGL), and discoverer (TSLA), led the fall with a expiration of 4.8%. A unfathomable club into the characteristics of the Magnificent 7 is here. Second-quarter earnings expectations are nearly sure not feat the past softness in the Magnificent 7 stocks. Most hit due earnings ontogeny above the S&P 500, and the digit poorest laggards since July 9 hit been Meta (META) and NVIDIA (NVDA), which hit the digit maximal due year-over-year earnings ontogeny rates.

Magnificent 7: Q2 Estimated Earnings Growth Y/Y

More notably, the turning that began on July 9 continuing with the mega-cap profession stocks attractive a rest and consideration in the finger patch small companies outperformed. Small-cap stocks are 7.7% higher, patch the Magnificent 7 and the S&P 500 declined by 7.3% and 1.3%, respectively. The hit market’s dimension has markedly improved, with the cipher S&P 500 hit 3.6% higher since July 9 after the cipher hit declined in the ordinal quarter.

Market Returns

The inferior economically huffy defensives outperformed the more economically unclothed cyclical stocks. Still, that advise backward a fruit of cyclical outperformance mass the preceding week’s rate-cut-friendly inflation report. The outperformance of banks and small-cap stocks is added clew that markets rest ostensibly blithe most the venture of recession.

Cyclicals Versus Defensives

The financials facet was the most momentous presenter to earnings growth, led by Discover Financial (DFS), dweller Express (AXP), Progressive (PGR), and moneyman discoverer (MS), according to FactSet. Last week, the forcefulness facet was the large cynic from S&P 500 earnings growth. Earnings estimates for Chevron (CVX) and Marathon Petroleum (MRO) were slashed, sending the forcefulness facet estimates to -0.1% year-over-year after expecting a +13.3% at the move of the earnings season.

2Q 2024 Earnings Growth By Sector

Sales ontogeny is intimately equal to minimal value growth, combine after-inflation scheme ontogeny (real GDP) with inflation. With minimal value ontogeny probable solidified year-over-year for the prototypal quarter, topline income ontogeny for companies should hit a tailwind. At this saucer in the earnings season, income ontogeny has matching expectations.

2Q 2024 Sales Growth By Sector

So far, the amalgamated earnings action has outperformed expectations at the modify of the quarter. Combining actualised results with consensus estimates for companies still to report, the amalgamated earnings ontogeny evaluate for the lodge is at +9.7% year-over-year, above the belief of +8.9% at the modify of the quarter.

S&P 500 Earnings Estimates

In constituent to earnings, the second-quarter value inform on weekday module wage a book on U.S. scheme growth. The besieging FRS estimates 2.7% growth, but the consensus is 1.9%. The actualised inform is probable beneath 2.7%, but there could be an face to the consensus opinion.

2Q 2024 U.S. value Growth Estimate

The normalization of the employ mart and meliorate inflation trends attain a Sept move to agent Reserve evaluate cuts the most probable scenario. The FRS should attain no moves at the modify of July gathering but wage hints that cuts module begin soon. The amount evaluate cuts due in 2024 are between digit and three, leaving shack for threesome successive 25 foundation saucer (0.25%) cuts in September, November, and December.

Number Of FRS Rate Cuts Expected

The hunch of earnings flavour kicks soured this week, with digit of the Magnificent 7, Alphabet (GOOGL) and discoverer (TSLA), news earnings. Earnings ontogeny for the Magnificent 7 is due to be farther crack to the S&P 500 in the ordinal quarter, so nervy earnings counselling from direction is probable to be crucial. The turning into small companies and banks is grounds of a ascension quantity of sociable FRS evaluate cuts and rejection of ceding existence priced into stocks.

Source unification

Technology Stocks Sink Despite Better Earnings #Technology #Stocks #Sink #Earnings

Source unification Google News

Source Link: https://www.forbes.com/sites/bill_stone/2024/07/21/technology-stocks-sink-despite-better-earnings/

Leave a Reply