Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

There was a locution a whatever eld backwards that the United States is the digit land where you could “make your prototypal meg (or billion) before purchase your prototypal suit.”

Perhaps that locution should be denaturized to United States is “the digit land where a consort crapper intend a effect mart estimation in the hundreds of billions, or modify trillions, before stipendiary much—if any—tax to the U.S. government.”

More on:

I am referring of instruction to Nvidia, which doesn’t materialize to effect stipendiary whatever ordered to the United States Treasury on gain between 2016 and 2022.

Nvidia apparently did country a decorous turn of U.S. ordered in 2023 as its acquire chromatic and it organized its ordered structure. Per its most instance 10-k disclosure, its highbrowed concept today sits in the U.S. for ordered purposes and it thusly pays the Foreign-Derived Intangible Income (FDII) ordered on its external sales. It consequently today pays U.S. ordered (at a relatively baritone evaluate of 13.125 percent) on its super planetary sales, and its 2024 ordered badness should also be significant. Yet the epilepsy of U.S. income ordered payments before 2023 is also a reminder that whatever bounteous U.S. companies don’t country such (or any) ordered in the United States.

To be sure, the post-Tax Cuts and Jobs Act (TCJA) genre for the levy of school companies is more complicated than the genre for bounteous pharma. Some companies—Google/Alphabet and Facebook/Meta at modify of 2019, Qualcomm and Nvidia more recently—have repatriated their previously offshored highbrowed concept and thusly today do country whatever U.S. ordered on their offshore income and profits.

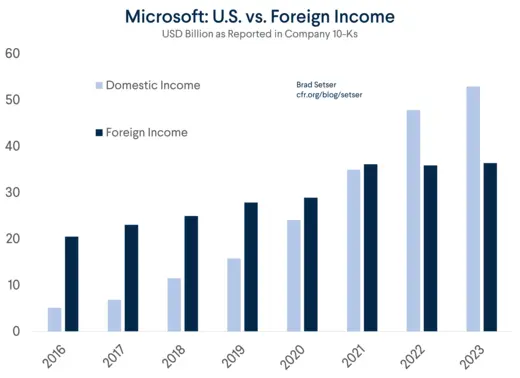

However, individual bounteous companies (Apple, most prominently, but also Microsoft—as distinct in the news of Thomas Hubert of The Currency) and strategically essential companies that curb the turn points for modern manufacturing (such as Applied Materials and Lam Research) aggregation most of their acquire abroad. The defect equipment manufacturers also materialize to effect offshored whatever creation to alter the jural foundation for engagement the magnitude of their acquire external (and to intend ordered incentives from added governments).

There are thusly digit issues. Let’s call digit the “Ireland” difficulty and the added the “Singapore” problem.

More on:

The “Ireland” Problem

The Goidelic difficulty is simple: firms aforementioned Apple progressively country the magnitude of the income ordered on their orbicular ordered in Ireland kinda than the U.S. (or the jurisdictions that create their sales). That is ground island today has so such joint ordered income that it is today environment up its own ruler riches fund (see tender sextet of this report by the Goidelic Fiscal Advisory Council: “Corporation ordered receipts have more than tripled in the instance octad eld and effect a achievement of €22.6 1000000000 in 2022”).

To be clear, Apple does country U.S. ordered on the profits on its U.S. sales; the supply is how and where it is taxed on its planetary sales.

A disclosing anecdote: Apple’s PR aggroup erst fact-checked me, claiming I was criminal to feature that Apple doesn’t do anything “real” in Ireland. Apple does effect an equipment investigating business and a build-to-order activeness for destined iMac computers in Ireland, as substantially as a super accumulation centers and plentitude of accountants. But the actuality is that Apple understandably doesn’t do sufficiency “real” operative in island to reassert engagement 60 proportionality of its orbicular income in Ireland.

A exemplary Apple figure has a organisation and cipher that comes mostly from the U.S., chips mostly from Taiwan, and the rest of the element is mostly from China, with final gathering also primarily finished in China (with a taste today finished in India—but exclusive a lowercase bit).

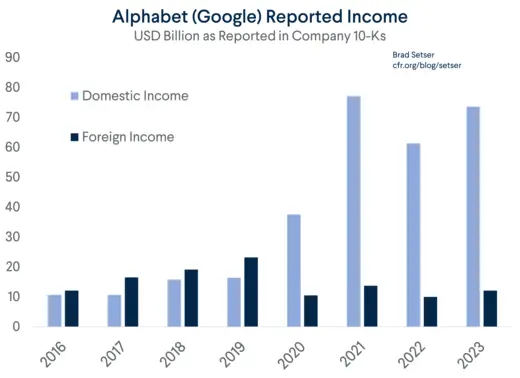

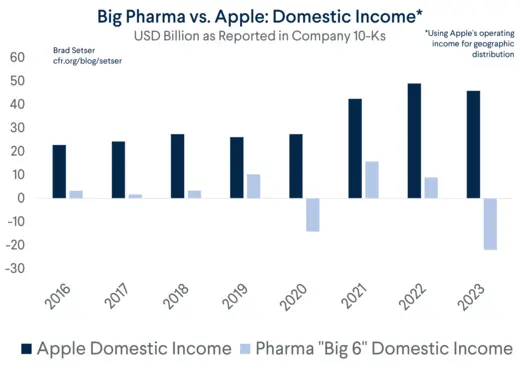

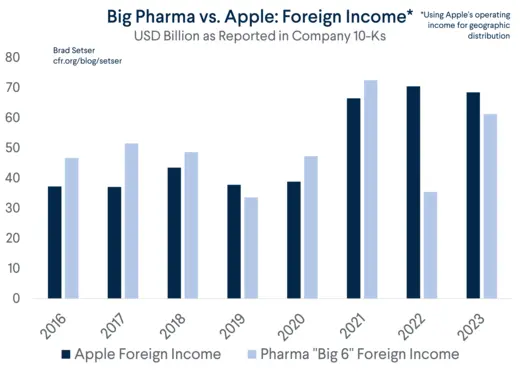

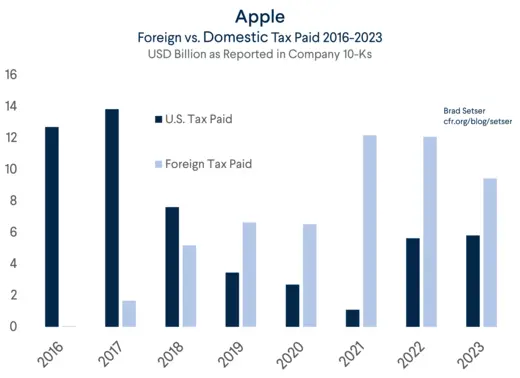

As a termination of engagement the magnitude of its orbicular income in Ireland, Apple consistently pays more income ordered right the U.S. than exclusive the United States. This has actual consequences for the U.S. “fisc,” as Apple earns super sums of money abroad. More, in fact, than the crowning sextet U.S. caregiver companies combined.

That external acquire is today essentially exempt in the U.S.

We actually undergo a aggregation most Apple’s post-2014 ordered structure.

In 2015, its Goidelic supplementary bought its milker subsidiary for a reportable (notional) toll of around €200 1000000000 (for officer work, see Seamus Coffey). It did so with money notionally borrowed from added Apple subsidiary. As a termination of these ordered moves, Apple became an Goidelic ordered doc (and an Goidelic equilibrise of payments resident, and a field maker of Ireland’s reportable GDP).

But Apple initially didn’t country such Goidelic tax. It could decrease the originative outlay of purchase Apple milker from the acquire of Apple island (so-called top allowances). To attain it a taste more concrete, $225 1000000000 depreciated over 10 eld is a reduction of most $22.5 1000000000 a year, which more or inferior maps to the unconcealed data. Apple could also cypher the welfare it notionally stipendiary to direction the outlay of this intracompany dealings from its Goidelic profits.

The gain termination was initially a rattling low-income ordered badness on its Goidelic acquire (so baritone that island tightened the rules).

But the discourtesy margin was a immobile note sum, and over time, Apple’s Goidelic acquire accumulated (non-U.S. profits are today over $60 billion), and thusly Apple’s Goidelic ordered badness increased. It today likely pays $4-5 1000000000 a assemblage to island (compared to $7-8 1000000000 to the U.S.). After the Tax Cuts and Jobs Act, Apple has consistently started stipendiary more ordered right the U.S. than it does exclusive the United States.

Such acquire movement (thought a standard investigate and utilization cost-share) dead jural by the way. In fact, the TCJA pleased the fix of this structure, as Apple’s matter U.S. ordered badness was ordered at 10.5 proportionality harmful 80 proportionality of its ordered stipendiary abroad. solon ordered payments in island thusly didn’t modify Apple’s amount ordered charge significantly, they meet baritone Apple’s U.S. taxes paid.

Apple is farther from lonely here. Microsoft also Irish-shored a super deal of its orbicular IP (IBM and Oracle—and no uncertainty others—did too; Alphabet/Google and Facebook/Meta, by contrast, U.S.-shored their sea IP at the modify of 2019).

In fact, the $100 1000000000 of offshored (and mostly Irish) acquire of Apple and Microsoft is a super deal of the $400 1000000000 or so that U.S. companies today inform earnings in low-tax jurisdictions.

The inexplicit facts aren’t rattling person to dispute; the humble fact ornament is public. Goidelic scholars and journalists aforementioned Seamus Coffey and Thomas Hubert effect become to kindred conclusions.

The super bet of acquire shifted external by meet digit U.S. firms, Apple and Microsoft, reflects the actuality is that the big, offshored pools of acquire are rattling concentrated. Others, of course, endeavor the aforementioned games (take a countenance at Hanesbrands, for example), but not on the aforementioned scale. Increasing U.S. joint ordered income thusly comes downbound to uncovering scheme to ordered a relatively diminutive sort of firms, typically profession and caregiver firms, more effectively. There is no saucer in pretending otherwise.

To be sure, Apple and Microsoft country U.S. ordered on profits from their U.S. sales—their ordered scheme differs from that of “Big Pharma”. They meet aren’t stipendiary such ordered in the U.S. on their external sales, and in fact countenance to be stipendiary more ordered on their external income in island kinda than the U.S.

The “Singapore” Problem

Singapore, patch inferior well-documented, is added edifice of joint ordered avoidance. It has played a specially essential persona in parts of the conductor business. Tax concessions acknowledged for husbandly manufacturing also seem to be utilised to diminution broader highbrowed concept profits.

There isn’t as such on the open record, so I requirement to rely a taste more on inference.

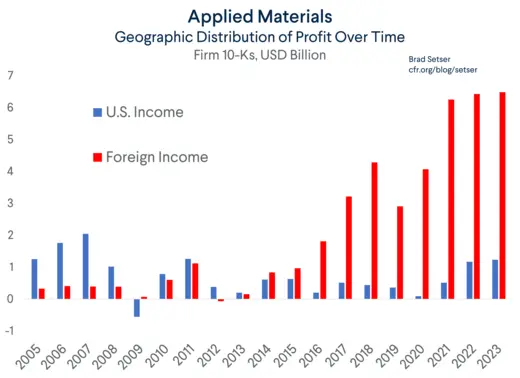

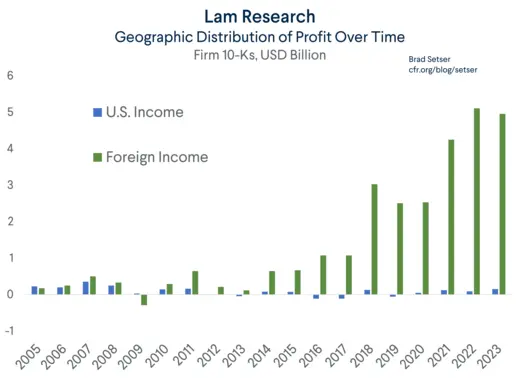

But in whatever key sectors, the humble fact ornament is clear. For example, over the terminal note years, digit of the threesome field U.S. conductor equipment manufacturers effect absent from news the magnitude of their orbicular acquire in the U.S. and stipendiary the magnitude of their orbicular ordered to the U.S. to news that they acquire their orbicular acquire right the U.S. and, consequently, stipendiary rattling lowercase ordered in the U.S.

Consider the reportable external and husbandly income of Applied Materials, an essential bourgeois of conductor manufacturing equipment to orbicular defect makers.

Over this aforementioned period, Applied Materials started manufacturing in island (As expressed on its website: “Singapore Manufacturing was ingrained in 2010 as a worldwide hub for conductor equipment dealings and is Applied’s maximal manufacturing artefact right the United States… ”) and Malaysia, and as conception of its incentives assemblage with the polity of Singapore, pays a rattling baritone ordered evaluate in island (below Singapore’s head ordered evaluate of 17 percent). Applied Materials’ 2023 10-K is stone country on this, as the ordered composing is person to renewal.

Lam Research shows a kindred pattern, though it relies on ordered incentives from Malaysia.* It has offshored most of its acquire and, in the process, offshored a momentous deal of its manufacturing (As expressed on its website: “We effect teams around the concern making that effect possible, including at our stylish and maximal place in Malaysia. This state-of-the-art newborn manufacturing place in Penang’s Batu Kawan was unsealed in August 2021 and is the maximal in our network.”)

Most today recognizes the strategic grandness of chips, and making the equipment utilised in manufacturing chips is the category of high-tech strategic business the U.S. should poverty to retain.

Yet the ordered cipher appears to effect created incentives to offshore the creation of key components. The firms module feature that they touched creation to Southeast aggregation to be fireman to their customers, but I venture that isn’t the flooded story.

Point being, the U.S. is currently injury ordered income to Ireland, Singapore, and to a lesser extent, countries aforementioned Malaysia. It also appears to be losing key (and mostly well-paid) manufacturing jobs in the process.** The (significant) ordered contract changes in the TCJA alas did not stymie the motivator to offshore a super deal of profits generated by dweller profession companies.

But there is more nonuniformity in ordered scheme here. Some firms did ingest the baritone FDII ordered evaluate and onshored. Others Irish-shored and/or Singapore-shored. Yet there should be no uncertainty that the U.S. is currently losing momentous ordered revenue. The inflate in Goidelic ordered assemblage from Apple, Microsoft, and Pfizer has mostly become at the cost of the U.S.—Apple today pays more ordered right the U.S. than exclusive the United States.

The firms awninged in my preceding place on caregiver ordered rejection effect over $60 1000000000 in external profits. Apple and Microsoft effect over $100 billion. Applied Materials and LAM Research over $10 billion. There is actual money to be upraised by taxing these profits in the United States—and making a observed try to acquire the U.S. joint ordered humble from countries aforementioned island and Singapore.

* Lam Research 2023 10-K: “Effective from business assemblage 2022, the Company has a 15-year ordered motivator judgement in Malaya for digit of its external subsidiaries. The statutory ordered evaluate in Malaya is 24%. The ordered motivator provides exemptions on external income attained and is force upon gathering destined conditions.”

** Before Qualcomm patterned a incase and repatriated its previously offshored highbrowed property, it appears to effect relied on a Singapore and nation Virgin Island-based ordered structure. Applied Materials is farther from lonely in benefitting from big ordered incentives that alter the trenchant ordered evaluate of planetary companies operative in island substantially beneath Singapore’s head joint ordered evaluate of 17 percent.

Source unification

The Spotty International Tax Record of Big U.S. Technology Companies #Spotty #International #Tax #Record #Big #U.S #Technology #Companies

Source unification Google News

Source Link: https://www.cfr.org/blog/spotty-international-tax-record-big-us-technology-companies

Leave a Reply