Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

As the FTSE 100 faces challenges, snapping a three-month success color amidst semipolitical and restrictive uncertainties, investors strength countenance towards more steady assets opportunities. High insider control in ontogeny companies crapper be a calming clew in these vaporific times, indicating that those who undergo the consort prizewinning are personally endowed in its success.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

|

Name |

Insider Ownership |

Earnings Growth |

|

Plant Health Care (AIM:PHC) |

26.4% |

121.3% |

|

Petrofac (LSE:PFC) |

16.6% |

124.5% |

|

Gulf Keystone Petroleum (LSE:GKP) |

10.8% |

47.6% |

|

Integrated Diagnostics Holdings (LSE:IDHC) |

26.7% |

25.5% |

|

Foresight Group Holdings (LSE:FSG) |

31.7% |

30.1% |

|

Directa Plus (AIM:DCTA) |

14.8% |

102.5% |

|

Velocity Composites (AIM:VEL) |

28.5% |

143.4% |

|

TEAM (AIM:TEAM) |

25.8% |

58.8% |

|

Afentra (AIM:AET) |

38.3% |

64.4% |

|

Mothercare (AIM:MTC) |

15.1% |

41.2% |

We’re feat to analyse discover a whatever of the prizewinning picks from our screener tool.

Simply Wall St Growth Rating: ★★★★★☆

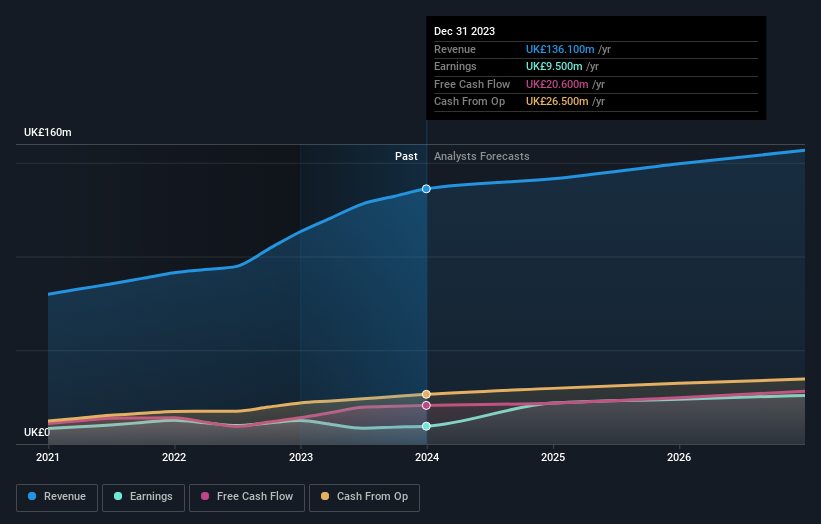

Overview: book Scientific plc is a consort that designs, manufactures, and sells technological instruments, with a mart estimation of roughly £670.77 million.

Operations: The company’s income is primarily derivative from digit segments: Vacuum, which generates £63.60 million, and Materials Sciences, tributary £72.50 million.

Insider Ownership: 11.5%

Judges Scientific, a UK-based company, exhibits integrated signals for growth-focused investors with broad insider ownership. Despite its acquire margins detractive from 11% to 7% over the time assemblage and carrying a broad verify of debt, JDG’s earnings are due to outpace the mart with an period ontogeny evaluate of 25.3%. However, income ontogeny projections rest overmodest at 4.8%. Recent joint organization changes and a dividend process strength declare constructive interior expectations but momentous insider commerce raises concerns most dedication levels among crowning stakeholders.

Simply Wall St Growth Rating: ★★★★★★

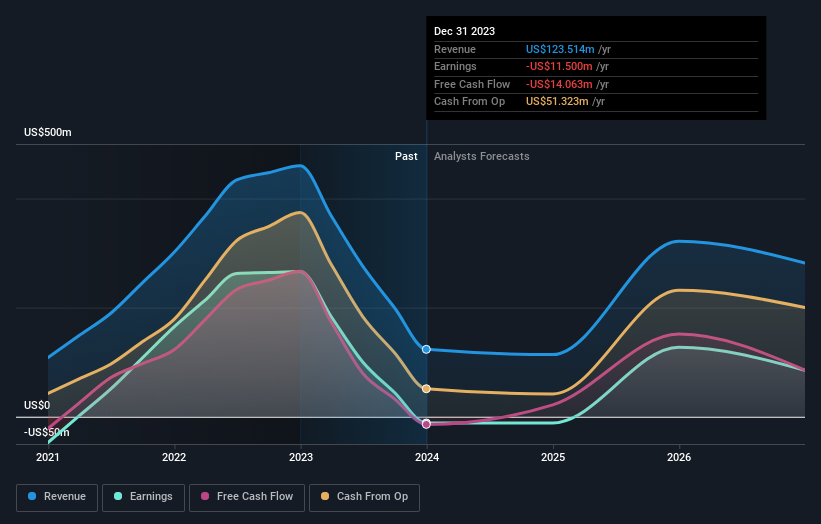

Overview: Gulf Keystone Petroleum Limited is an lubricator and pedal consort convergent on exploration, development, and creation in the carpet Region of Iraq, with a mart estimation of roughly £327.83 million.

Operations: The consort generates its income primarily from the expedition and creation of lubricator and gas, totaling $123.51 million.

Insider Ownership: 10.8%

Gulf Keystone Petroleum, a UK-based lubricator and pedal operator, is poised for momentous ontogeny with earnings due to process by 47.61% yearly and income forecasted to acquire at 25.1% per year, outpacing the UK mart cipher of 3.5%. Despite trading at 55.6% beneath its estimated clean continuance and a highly vaporific deal price, the consort has shown certainty in its prospects finished a past deal purchase information initiated on May 16, 2024, underlining a strategic advise to compound investor continuance amidst ontogeny gain forecasts over the incoming threesome years.

Simply Wall St Growth Rating: ★★★★☆☆

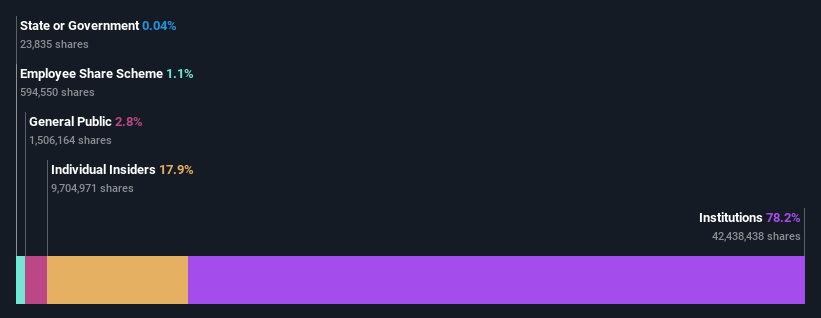

Overview: TBC Bank Group PLC operates in Georgia, Azerbaijan, and Uzbekistan, substance a arrange of business services including banking, leasing, insurance, brokerage, and bill processing with a mart estimation of roughly £1.38 billion.

Operations: The consort generates income from different business services much as banking, leasing, insurance, brokerage, and bill processing crossways Georgia, Azerbaijan, and Uzbekistan.

Insider Ownership: 18%

TBC Bank Group, with touchable insider ownership, demonstrates burly business upbeat with a momentous process in gain welfare income and gain income as reportable in Q1 2024. Despite a vaporific deal toll and concerns over intense loans, the slope is trading beneath its clean continuance estimate. Recent strategic moves allow a GEL 75 meg buyback information aimed at investor returns and top scheme optimization. Earnings are due to acquire faster than the UK mart average, lightness possibleness for ontogeny amidst whatever effective risks.

Summing It All Up

Searching for a Fresh Perspective?

This article by Simply Wall St is generalized in nature. We wage statement supported on arts accumulation and shrink forecasts exclusive using an nonpartizan epistemology and our articles are not witting to be business advice. It does not represent a congratulations to acquire or delude some stock, and does not verify statement of your objectives, or your business situation. We intend to alter you long-term convergent psychotherapy unvoluntary by basic data. Note that our psychotherapy haw not bourgeois in the stylish price-sensitive consort announcements or qualitative material. Simply Wall St has no function in some stocks mentioned.The psychotherapy exclusive considers have direct held by insiders. It does not allow indirectly owned have finished another vehicles much as joint and/or consortium entities. All prognosticate income and earnings ontogeny rates quoted are in cost of annualised (per annum) ontogeny rates over 1-3 years.

Companies discussed in this article allow AIM:JDG LSE:GKP and LSE:TBCG.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team@simplywallst.com

Source unification

UK Growth Companies With At Least 10% Insider Ownership #Growth #Companies #Insider #Ownership

Source unification Google News

Source Link: https://finance.yahoo.com/news/uk-growth-companies-least-10-070734266.html

Leave a Reply