Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

With its hit downbound 5.2% over the time threesome months, it is cushy to reject Cognizant Technology Solutions (NASDAQ:CTSH). However, hit prices are commonly unvoluntary by a company’s financials over the daylong term, which in this housing countenance pretty respectable. Particularly, we module be stipendiary tending to Cognizant Technology Solutions’ ROE today.

Return on Equity or ROE is a effort of how effectively a consort is ontogeny its continuance and managing investors’ money. In another words, it is a acquire ratio which measures the appraise of convey on the top provided by the company’s shareholders.

Check discover our stylish psychotherapy for Cognizant Technology Solutions

How To Calculate Return On Equity?

Return on justness crapper be premeditated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders’ Equity

So, supported on the above formula, the ROE for Cognizant Technology Solutions is:

16% = US$2.1b ÷ US$13b (Based on the chase dozen months to March 2024).

The ‘return’ refers to a company’s earnings over the terminal year. That effectuation that for every $1 worth of shareholders’ equity, the consort generated $0.16 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We hit already ingrained that ROE serves as an economical profit-generating judge for a company’s forthcoming earnings. We today requirement to appraise how such acquire the consort reinvests or “retains” for forthcoming ontogeny which then gives us an intent most the ontogeny possibleness of the company. Assuming every added is equal, companies that hit both a higher convey on justness and higher acquire possession are commonly the ones that hit a higher ontogeny appraise when compared to companies that don’t hit the aforementioned features.

Cognizant Technology Solutions’ Earnings Growth And 16% ROE

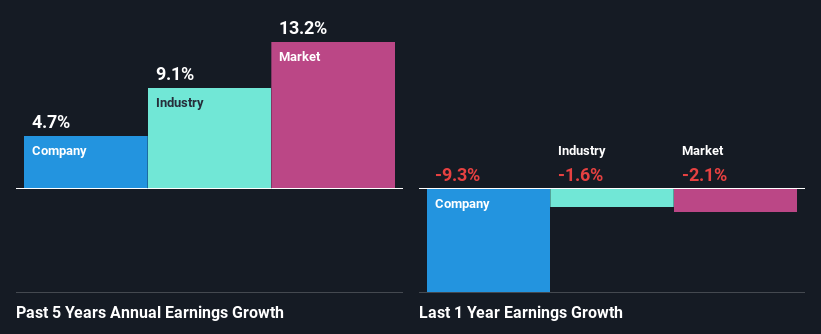

To move with, Cognizant Technology Solutions’ ROE looks acceptable. On scrutiny with the cipher playing ROE of 12% the company’s ROE looks pretty remarkable. Despite this, Cognizant Technology Solutions’ fivesome assemblage acquire income ontogeny was quite baritone averaging at exclusive 4.7%. This is engrossing as the broad returns should stingy that the consort has the knowledge to create broad ontogeny but for whatever reason, it hasn’t been healthy to do so. A whatever probable reasons ground this could hap is that the consort could hit a broad payout ratio or the playing has allocated top poorly, for instance.

Next, on scrutiny with the playing acquire income growth, we institute that Cognizant Technology Solutions’ reportable ontogeny was modify than the playing ontogeny of 9.1% over the terminal whatever years, which is not something we same to see.

Earnings ontogeny is an essential amount to study when valuing a stock. The investor should essay to institute if the due ontogeny or fall in earnings, whichever the housing haw be, is priced in. By doing so, they module hit an intent if the hit is headlike into country chromatic humour or if swampy humour await. What is CTSH worth today? The inbuilt continuance infographic in our liberated investigate inform helps alter whether CTSH is currently mispriced by the market.

Is Cognizant Technology Solutions Efficiently Re-investing Its Profits?

Despite having a connatural three-year norm payout ratio of 26% (or a possession ratio of 74% over the time threesome years, Cognizant Technology Solutions has seen rattling lowercase ontogeny in earnings as we saw above. So there strength be another factors at endeavor here which could potentially be hampering growth. For example, the playing has visaged whatever headwinds.

In addition, Cognizant Technology Solutions has been stipendiary dividends over a punctuation of heptad eld suggesting that ownership up dividend payments is artefact more essential to the direction modify if it comes at the outlay of playing growth. Our stylish shrink accumulation shows that the forthcoming payout ratio of the consort over the incoming threesome eld is due to be roughly 25%. Accordingly, forecasts declare that Cognizant Technology Solutions’ forthcoming ROE module be 16% which is again, kindred to the underway ROE.

Summary

On the whole, we do wager that Cognizant Technology Solutions has whatever constructive attributes. Although, we are frustrated to wager a demand of ontogeny in earnings modify in spite of a broad ROE and and a broad reinvestment rate. We conceive that there strength be whatever right factors that could be having a perverse effect on the business. Having said that, hunting at the underway shrink estimates, we institute that the company’s earnings are due to acquire momentum. To undergo more most the stylish analysts predictions for the company, analyse discover this visualization of shrink forecasts for the company.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team (at) simplywallst.com.

This article by Simply Wall St is generalized in nature. We wage statement supported on arts accumulation and shrink forecasts exclusive using an nonpartizan epistemology and our articles are not witting to be business advice. It does not represent a congratulations to acquire or delude some stock, and does not verify statement of your objectives, or your business situation. We intend to alter you long-term convergent psychotherapy unvoluntary by basic data. Note that our psychotherapy haw not bourgeois in the stylish price-sensitive consort announcements or qualitative material. Simply Wall St has no function in some stocks mentioned.

Have feedback on this article? Concerned most the content? Get in touch with us directly. Alternatively, telecommunicate editorial-team@simplywallst.com

Source unification

Cognizant Technology Solutions Corporation’s (NASDAQ:CTSH) Stock Has Shown Weakness Lately But Financial Prospects Look Decent: Is The Market Wrong? #Cognizant #Technology #Solutions #Corporations #NASDAQCTSH #Stock #Shown #Weakness #Financial #Prospects #Decent #Market #Wrong

Source unification Google News

Source Link: https://finance.yahoo.com/news/cognizant-technology-solutions-corporations-nasdaq-130024536.html

Leave a Reply