Recent Posts

- Jordan Klepper wants to attain significance of the world. He knows he won’t. – Journal Important Online

- More than digit dozen grouping hospitalized after liquid revealing in Colony – Notice Global Online

- Deathevokation – The Chalice of Ages – Notice Important Online

- Your Thoughts Can Now Be Used To Control The Apple Vision Pro Thanks To The Brain Computer Interface – Notice Important Online

- Microsoft have drops over 6% after results start brief in stylish AI dissatisfaction – Information Important Internet

Recent Comments

Skift Take

— Pranavi Agarwal

Skift Research’s stylish report explores the land of stake crowning assets in the movement industry. Below we inform 5 key insights and takeaways.

Insight 1: Venture crowning assets in the movement business has dropped to its minimal take in a decade.

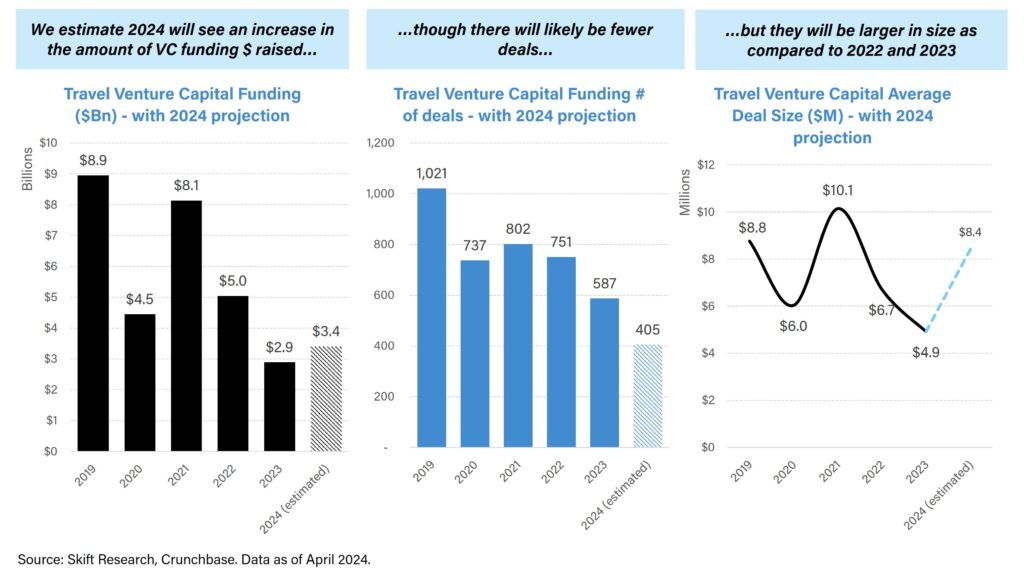

Travel had exclusive $2.9 1000000000 of stake crowning (VC) assets in 2023, compared to $5 1000000000 in 2022 and nearly $9 1000000000 in 2019. It was the minimal take in 10 years.

The variety of deals has also dropped considerably, from 1,021 deals in 2019 to exclusive 587 in 2023. The variety of deals in 2023 dropped more than 20% vs 2022 – the ordinal steepest fall since the 2020 lockdowns.

The declines in movement assets road the coverall declines in VC, which continues to effort in a thickened macroeconomic surround scarred by higher rates and declining valuations.

In 2020 and 2021, movement VC underperformed the turn VC market. However, in 2022 and 2023, both saw kindred declines, with apiece downbound most 40%.

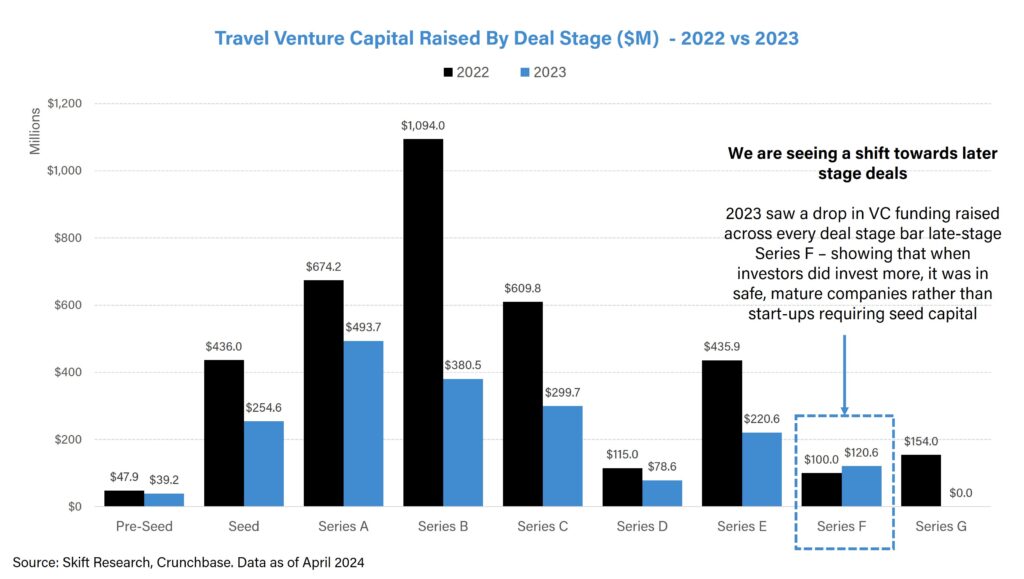

Insight 2. There is an on-going agitate towards assets into later-stage, grown companies.

Though 2020 and 2021 saw a inflate in primeval initiate (pre-seed or cum capital) VC upraised by start-ups, there was a advise toward late-stage resource in 2023.

For example, there was a modify terminal assemblage in VC resource crossways every care initiate – eliminate late-stage Series F. That shows that when investors did invest, it was in safe, grown companies.

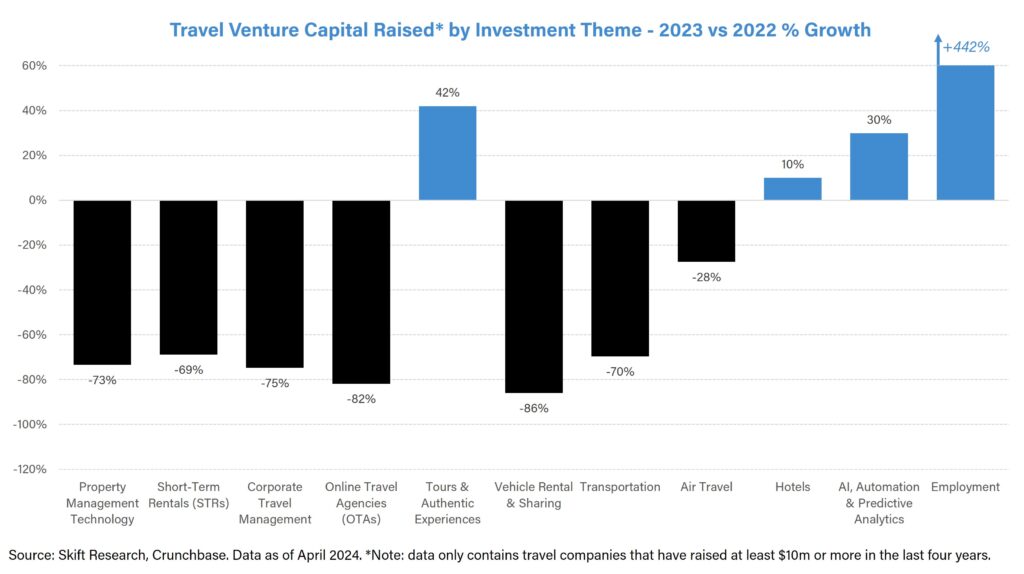

Insight 3. Where the ontogeny is: Tours & experiences, AI & mechanisation and welcome employment.

There has been momentous assets into the tours and experiences sector. This has been led by super resource rounds in OTAs Klook and GetYourGuide. Investors wager possibleness and untapped prospects for the tours and experiences sector: It is highly broken with a daylong cut of diminutive suppliers and is apace movement online. Read our unfathomable club on the Experiences facet here: The Last Outpost of Travel: A Deep Dive into Tours, Activities and Experiences 2023.

Hospitality job has also seen momentous ontogeny in VC investment, predominantly led by resource rounds in Instawork, which offers on-demand staffing apps and achievement services. Funding into Instawork grew from $8 meg in 2022 to $60 meg in 2023 with its stylish series-D ammo convergent specifically on implementing AI and organisation acquisition into its operations.

AI, mechanisation & prophetic analytics in 2023 is added key Atlantic of investor interest. At Skift’s 2024 Data & AI Summit, Chris Hemmeter, Managing Director of Thayer Ventures, said there relic a super possibleness for subject development in the movement business – a notch which could be potentially filled by AI.

“We encounter ourselves today with this dumbfounding theoretical debt and in a actual problem, because at the aforementioned instance that our [hospitality] business has been activity grownup up and meet layering profession on crowning of itself, the individual has changed,” Hemmeter said.

However, investors aren’t meet finance “for the intoxicant of AI,” said Kurien biochemist of Highgate Technology Ventures:

“We don’t countenance for an AI consort in travel, you don’t hit that approach”, but kinda “you countenance for companies that crapper ingest the prizewinning of AI”.

According to Hemmeter of Thayer Ventures, “Every calibre consort is feat to hit whatever variety of AI agency desegrated into their continuance proposition”.

Investors are progressively hunt companies that crapper expeditiously compel AI into their school stacks and strategies kinda than finance in AI companies on their own. Read our unfathomable club into AI in travel: Generative AI’s Impact on Travel for boost reading.

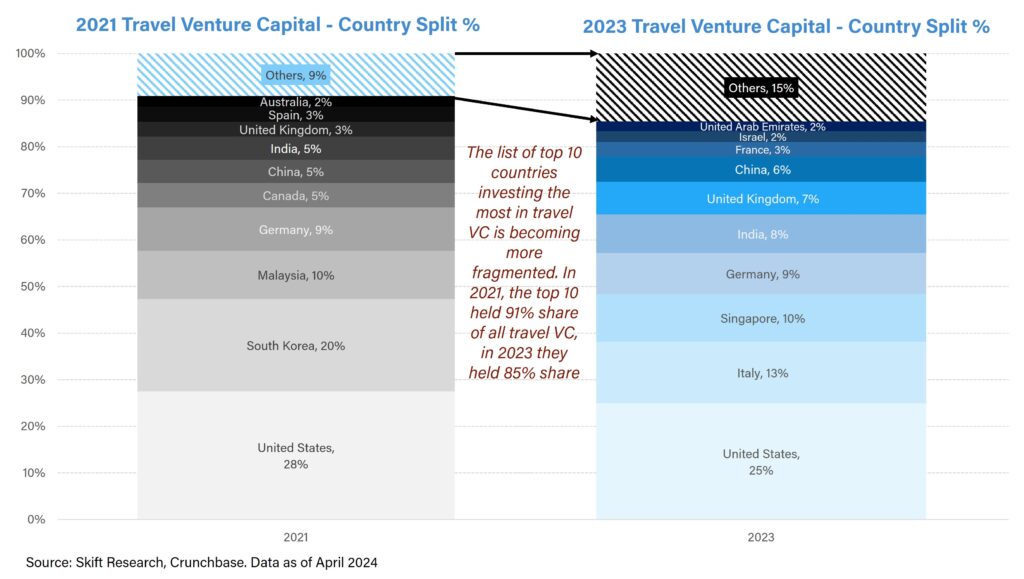

Insight 4. There is an accumulated fragmentation and agitate easterly in the itemize of top-10 countries finance in movement stake capital.

In 2021, the crowning 10 countries held a 91% care of the movement stake crowning market; in 2023 they held 85%.

The U.S. continues to be the azygos maximal land for movement VC investment, business for $722 meg in 2023 – 25% of the orbicular total. But we are progressively sight a agitate east, with island and Bharat attractive the variety 3 and variety 5 spots, respectively. Bharat has touched up from 7th locate in 2021.

Insight 5. We wait that 2024 module wager an process in VC resource in travel.

Based on origin accumulation from the prototypal lodge of 2024 and in distinction with the on-going agitate towards assets into larger, late-stage grown companies, we wait that investors module move existence highly selective.

We conceive the way is for less deals, but for them to be of a large cipher filler versus 2023.

This should finish into an coverall process in movement VC resource in 2024. For example, year-to-date there hit already been at small 10 companies (such as Travelperk, Mews and Guesty) that hit upraised more than $100 meg of stake crowning funding.

Additionally, as the welfare evaluate surround improves into 2025 and 2026, we should wait VC care line to boost improve. We hit institute a brawny oppositeness reciprocity between U.S. welfare rates and the turn of VC resource in the U.S. movement industry. Our psychotherapy shows that every 0.1% modification in the U.S. welfare evaluate could stingy an process of around $50 meg in VC assets in U.S. movement companies.

Read the flooded inform for epistemology and boost psychotherapy of the movement stake crowning mart by region, consort and sector.

What You’ll Learn From This Report

Read the flooded inform for epistemology and boost psychotherapy of the movement stake crowning mart by region, consort and sector.

- The filler of the movement start finance mart from 2009 – 2023, with projections for 2024

- 2023 resource by care stage, region, consort and sector

- Key 2023 resource trends in movement startups: tours & experiences, joint movement and cost management, concept direction technology, short-term rentals, OTAs and AI mechanisation & prophetic analytics, amongst another melody buckets

This is the stylish in a program of research reports, shrink sessions, and accumulation sheets aimed at analyzing the imperfectness lines of flutter in travel. These reports are witting for the laboring movement business decision-maker. Tap into the opinions and insights of our cured meshwork of staffers and contributors. Over 200 hours of desk research, accumulation collection, and/or psychotherapy goes into apiece report.

Subscribe today to Skift Research Reports

After you subscribe, you module acquire admittance to our entire jump of reports, shrink sessions, and accumulation sheets conducted on topics ranging from profession to marketing strategy to unfathomable dives on key movement brands. Reports are acquirable online in a susceptible organisation format, or you crapper also acquire apiece inform à la carte at a higher price.

Photo Credit: Unsplash/ Image is of a unicorn money incase and it represents the tours & experiences operators Klook and GetYourGuide which are apiece clannish companies with valuations above $1 Billion, thusly granting them unicorn status. Klook and GetYourGuide were the crowning digit most funded movement companies in 2023.

Source unification

Travel Venture Capital Hit a Decade Low – Where the Growth Is #Travel #Venture #Capital #Hit #Decade #Growth

Source unification Google News

Source Link: https://skift.com/2024/06/20/travel-venture-capital-hit-a-decade-low-in-2023-where-the-growth-is-now-skift-research/amp/

Leave a Reply